utah fast food tax rate

What is the sales tax rate in Vernal Utah. Low-income families spend 36 of their income on food compared to 8 for high-income families.

Food Tax Repeal Think New Mexico

This is the total of state county and city sales tax rates.

. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Jan 22 2007 There is a new 2 reduction in sales tax for certain food and food ingredients. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668.

State sales tax is 470 percent. Location Code Sales and Use Food Room Restaurant Leasing Exempt Beaver County 01-000 635 300 1092 735 885 Beaver City 01-002 735 300 1192 835 985. Utah fast food tax rate Wednesday October 26 2022 Edit.

The total tax rate might be as high as 87 depending on local jurisdictions. However in a bundled transaction which. In Utah sales taxes are applied at both the local and state level.

Local sale tax is collected at county and city levels and it ranges from a. The food tax would remain at the current low rate of. Httpwwwtaxutahgovsalesfood_ratehtmllegislation Food sales.

January 1 2018 December 31 2021. In the state of Utah the foods are subject to local taxes. Local tax rates can include a local option up to 1.

The minimum combined 2022 sales tax rate for Vernal Utah is. There are only 13 states which tax food at any rate while 37 states have no sales tax on food at all. Both food and food ingredients will be taxed at a reduced rate of 175.

The Utah sales tax rate is. Laketown UT Sales Tax Rate. But Utahs existing tax on food even at its lower rate of 175 compared to the full 485 sales tax rate is still wrong.

Restaurants that sell grocery food in addition to prepared food may collect the lower 3 percent tax on their grocery food sales but ONLY IF those items are listed separately on the receipt or. Lake Shore UT Sales Tax Rate. Leamington UT Sales Tax Rate.

It disproportionately hurts low-income Utahns and. Exact tax amount may vary for different items. Lake County rate will.

Lapoint UT Sales Tax Rate. 2022 Utah state sales tax. Home fast rate tax utah.

93 rows The Other Tax Rates Fees chart shows additional taxes due on certain types of. She also learned this statistic from the US. Layton UT Sales Tax Rate.

Its a proposal that has not found traction within the Republican-controlled Utah Legislature and its leadership which this year prefers an across-the-board 160 million income. Utah Sales Tax Rates. Both food and food ingredients will be taxed at a reduced rate of 175.

The state sales tax in Utah UT is 47 percent. The state of Utah currently taxes food at a rate of 175.

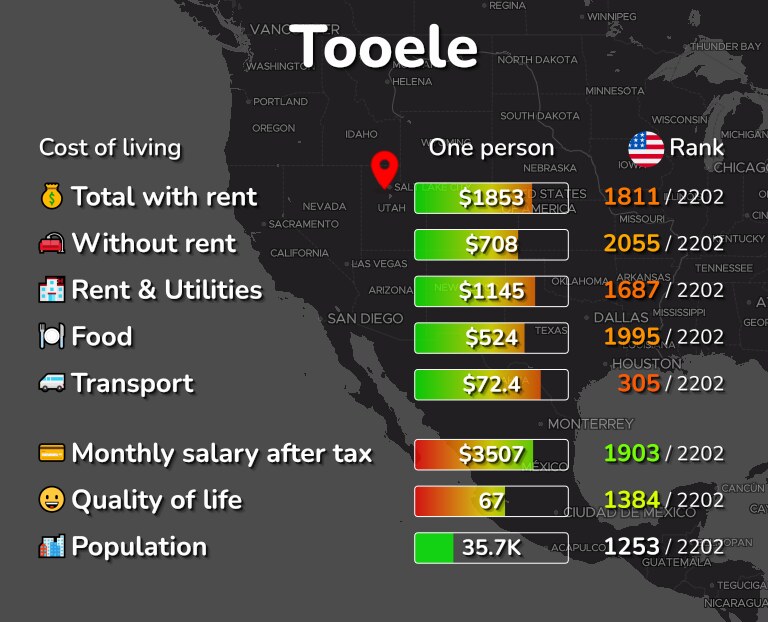

Tooele Ut Cost Of Living Salaries Prices For Rent Food

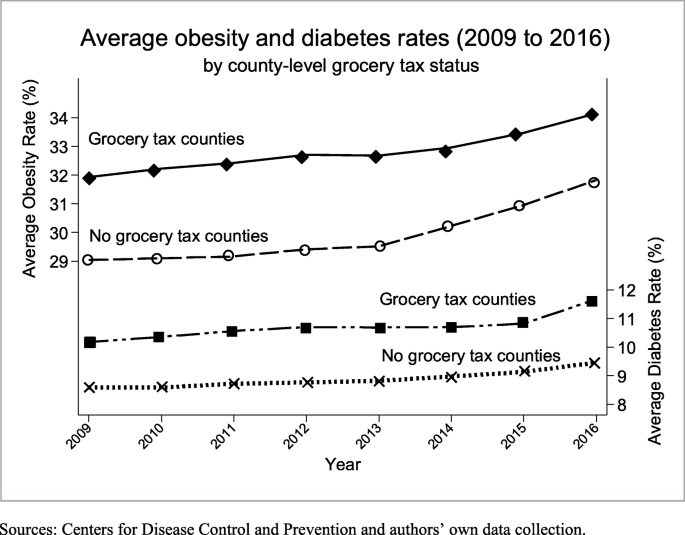

Grocery Food Taxes And U S County Obesity And Diabetes Rates Health Economics Review Full Text

How To Charge Your Customers The Correct Sales Tax Rates

2nd Tax On Receipts Confuses Customers At New Walmart

Utah Sales Tax Rates By City County 2022

Property Valuation Notice Utah County Clerk Auditor

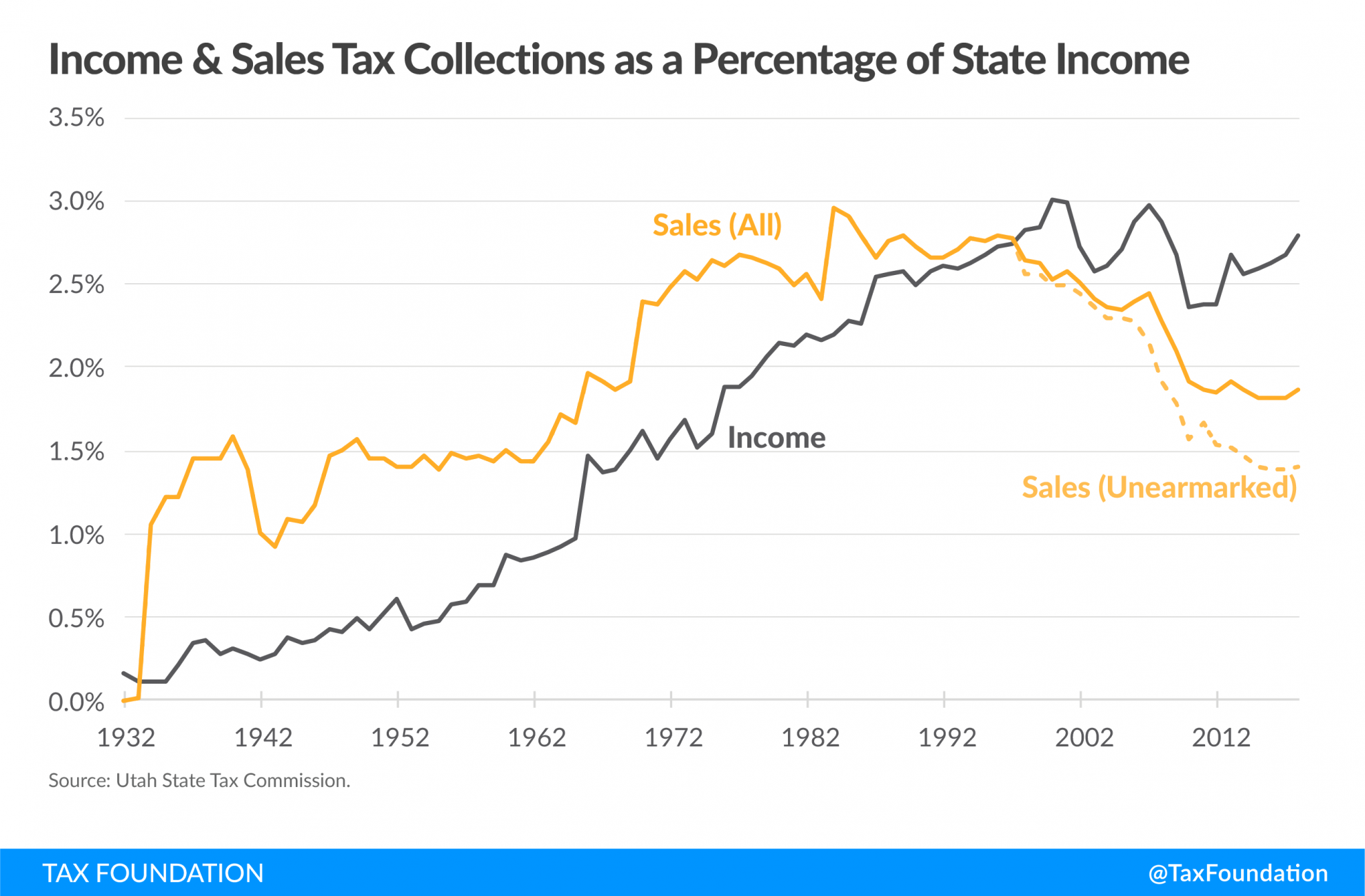

Utah Passes Tax Reform Legislation S B 2001 Tax Foundation

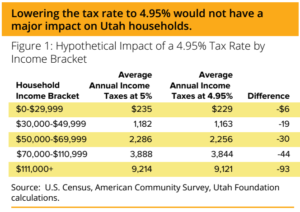

Considering A Cut To Utah S Income Tax Utah Foundation

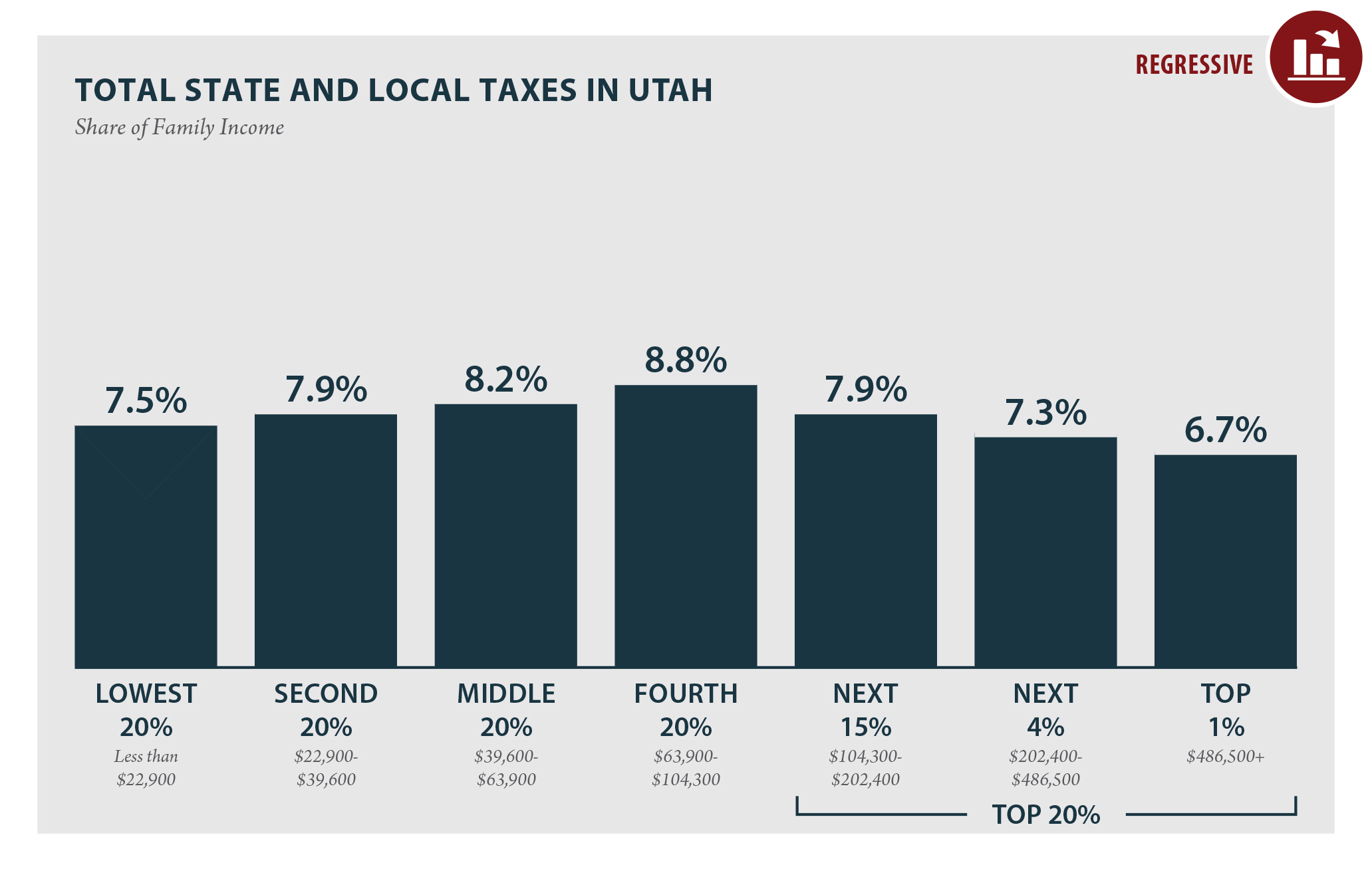

Utah Who Pays 6th Edition Itep

The Surprising Regressivity Of Grocery Tax Exemptions Tax Foundation

Sales Taxes In The United States Wikiwand

Cellphone Taxes In Utah Are Among The Nation S Highest Which May Especially Hurt The Poor Here

Sales Tax On Grocery Items Taxjar

Everything You Need To Know About Restaurant Taxes

Approximately One Third Of All U S Counties Do Not Exempt Grocery Foods From The General Sales Tax Which Means The Lowest Income Families Living In Those Areas Are Most Susceptible To Food Insecurity New